Ever felt like accounting speaks a different language, filled with confusing terms like “debits” and “credits”? You’re definitely not alone! These two words are at the very heart of how businesses track every dollar, but they often intimidate newcomers.

The good news? In accounting, “debit” and “credit” have a very specific, logical, and surprisingly simple job. And today, we’re going to demystify them for you in under 5 minutes! Yes, you read that right – quick, clear, and actionable insights.

Why Debits and Credits Are Your Accounting Superpowers

Forget everything you think you know about “debit” from your bank card. In the world of accounting, Debits and Credits are the two sides of every financial story. They are the essential tools we use to record both the incoming and outgoing flow of value in every single business transaction.

This powerful system is called double-entry accounting. It’s brilliant because it forces your books to stay balanced. Every action has an equal and opposite reaction: what goes out of one account must be matched by what comes into another. The golden rule you’ll live by? Total Debits must always equal Total Credits. This is the secret sauce for accurate, reliable financial records.

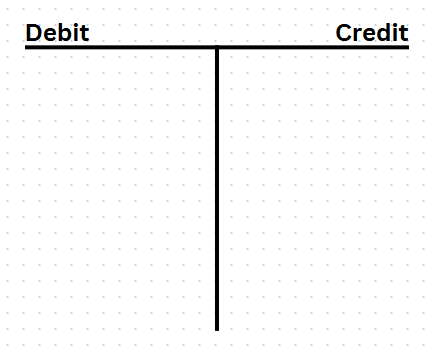

The “T” Account: Your Visual Guide

To truly grasp Debits and Credits, imagine a simple “T” on a page:

- The left side of the “T” is always for Debits.

- The right side of the “T” is always for Credits.

Simple, right? Now, let’s see how these “T” sides change the five main types of accounting accounts. Get ready for some clear examples!

1. Assets: What Your Business Owns (Think Cash, Equipment, Buildings)

- To make an Asset bigger: Use a Debit (record on the left)

- To make an Asset smaller: Use a Credit (record on the right)

- Example: You buy a new computer for $1,000 cash.

- Your “Equipment” (an Asset) increases, so you Debit it.

- Your “Cash” (an Asset) decreases, so you Credit it.

- Example: You buy a new computer for $1,000 cash.

2. Liabilities: What Your Business Owes (Think Loans, Bills to Pay)

- To make a Liability bigger: Use a Credit (record on the right)

- To make a Liability smaller: Use a Debit (record on the left)

- Example: You take out a $5,000 bank loan.

- Your “Cash” (an Asset) increases, so you Debit it.

- Your “Loans Payable” (a Liability) increases, so you Credit it.

- Example: You take out a $5,000 bank loan.

3. Equity: The Owner’s Stake (The owner’s investment + profits – withdrawals)

- To make Equity bigger: Use a Credit (record on the right)

- To make Equity smaller: Use a Debit (record on the left)

- Example: The owner invests $10,000 personal cash into the business.

- Your “Cash” (an Asset) increases, so you Debit it.

- “Owner’s Capital” (Equity) increases, so you Credit it.

- Example: The owner invests $10,000 personal cash into the business.

4. Revenue: Money Your Business Earns (From sales of goods or services)

- To make Revenue bigger: Use a Credit (record on the right)

- To make Revenue smaller: Use a Debit (record on the left)

- Example: You provide a consulting service and receive $500 cash.

- Your “Cash” (an Asset) increases, so you Debit it.

- “Service Revenue” increases, so you Credit it.

- Example: You provide a consulting service and receive $500 cash.

5. Expenses: Costs of Running Your Business (Think Rent, Salaries, Utilities)

- To make an Expense bigger: Use a Debit (record on the left)

- To make an Expense smaller: Use a Credit (record on the right)

- Example: You pay the monthly internet bill for $75.

- “Internet Expense” increases, so you Debit it.

- Your “Cash” (an Asset) decreases, so you Credit it.

- Example: You pay the monthly internet bill for $75.

Your Quick Reference Cheat Sheet:

| Account Type | To Increase | To Decrease |

|---|---|---|

| Assets | Debit | Credit |

| Expenses | Debit | Credit |

| Liabilities | Credit | Debit |

| Equity | Credit | Debit |

| Revenue | Credit | Debit |

Ready to See it in Action?

Reading about it is one thing, but seeing it come to life makes all the difference! I’ve packed all these examples and explanations into a concise, easy-to-follow video.

🎥 Watch my video:

Mastering Debits and Credits is your first, incredibly important step into understanding how financial transactions are recorded, how financial statements are built, and ultimately, the true financial picture of any business. It’s the language of money, and you’re about to become fluent!

What accounting concept has confused you the most? Share your thoughts in the comments below! We’re building a library of easy-to-understand accounting guides, and your feedback helps us choose our next topic.