Depreciation is the process of allocating the cost of a long-term asset over its useful life. It reflects the fact that assets lose value over time due to wear and tear, obsolescence, or other factors. Depreciation is an important concept in accounting, as it affects the income statement, the balance sheet, and the cash flow statement. and in this blog post we will go through the Journal Entries for Depreciation.

How to Record Journal Entries For Depreciation

As an accountant you record depreciation as an expense on the income statement, reducing the net income and the earnings per share. However, depreciation does not affect the cash flow of the business, as it is a non-cash expense. Read more about non-cash expenses. Therefore, we add depreciation back to the net income in the cash flow statement, which increases the operating cash flow.

To record the journal entry for depreciation, the accountants has to make a journal entry at the end of each accounting period, debiting the depreciation expense account and crediting the accumulated depreciation account. The depreciation expense account is an income statement account, while the accumulated depreciation account is a contra-asset account that reduces the carrying value of the asset on the balance sheet.

The journal entry for depreciation can be written as:

Depreciation Expense Dr XXX Accumulated Depreciation Cr XXXWhere XXX is the amount of depreciation for the period.

How to Calculate Depreciation

There are different methods of calculating depreciation, depending on the nature of the asset and the preference of the business. Some of the common methods are:

- Straight-line method: This method allocates the same amount of depreciation every year, based on the original cost, the salvage value, and the useful life of the asset. The formula for the annual depreciation expense is:

- Units-of-production method: This method allocates depreciation based on the actual usage or output of the asset, rather than the passage of time. The formula for the depreciation expense per unit is:

To determine the total depreciation expense for the period, multiply the depreciation expense per unit by the number of units produced or used during that time.

- Double-declining balance method: This method allocates more depreciation in the earlier years of the asset’s life, and less in the later years. It is based on the assumption that the asset loses more value in the beginning, due to rapid obsolescence or deterioration. The formula for the annual depreciation rate is:

The depreciation expense for each year is then calculated by multiplying the depreciation rate by the book value of the asset at the beginning of the year. The book value is the original cost minus the accumulated depreciation. Also, it’s important to take a look at depreciation rates.

Example of Journal Entries for Depreciation

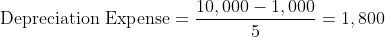

Let’s assume that a company purchases a machine for $10,000, with a salvage value of $1,000 and a useful life of 5 years. The company uses the straight-line method of depreciation. The annual depreciation expense is:

The journal entry for the first year of depreciation is:

Depreciation Expense Dr 1,800 Accumulated Depreciation Cr 1,800nThe journal entry for the second year of depreciation is:

Depreciation Expense Dr 1,800 Accumulated Depreciation Cr 1,800And so on, until the fifth year, when the book value of the asset becomes equal to the salvage value.

The effect of these journal entries on the financial statements is:

- The income statement shows a depreciation expense of $1,800 every year, reducing the net income and the earnings per share.

- The balance sheet shows the machine as an asset with a cost of $10,000. Accumulated depreciation is $1,800 in year one, $3,600 in year two, and so on, reaching $9,000 in year five. The net book value is calculated by subtracting accumulated depreciation from the cost. This results in $8,200 in year one, $6,400 in year two, and finally $1,000 in year five.

- The cash flow statement shows the purchase of the machine as a cash outflow of $10,000 in the investing activities section, and the depreciation expense as a non-cash adjustment of $1,800 every year in the operating activities section, increasing the operating cash flow.

Advantages and Disadvantages of Depreciation

Depreciation has some advantages and disadvantages for the business, depending on how it is used and reported. Some of the advantages are:

- Tax benefits: Depreciation reduces the taxable income of the business, lowering the tax liability and increasing the after-tax cash flow.

- Matching principle: Depreciation matches the cost of the asset with the revenue generated by the asset over its useful life, following the accounting principle of matching expenses with revenues.

- Asset replacement: Depreciation helps the business plan for the replacement of the asset when it reaches the end of its useful life, by setting aside funds from the depreciation expense.

Some of the disadvantages are:

- Overstatement of net income: Depreciation, based on estimates and assumptions, can inflate net income and distort the return on assets if those estimates don’t match reality, potentially misleading investors and creditors.

- Understatement of asset value: Depreciation deflates asset values on the balance sheet, which might not align with their actual fair value or resale potential. This can understate total assets and equity, impacting key financial ratios and the company’s creditworthiness.

- Complexity and inconsistency: The process of choosing depreciation methods, rates, salvage values, and useful lives for assets can introduce complexity and inconsistency into accounting and reporting. This makes it challenging to compare the financial performance and position of different companies.

Summary and Takeaways

In this blog post, we have learned about the concept of depreciation:

- how to record it in journal entries

- how to calculate it using different methods

- what are the advantages and disadvantages of depreciation for the business.

Here are some key takeaways from this post:

- Depreciation is the process of allocating the cost of a long-term asset over its useful life, reflecting the loss of value due to wear and tear, obsolescence, or other factors.

- Depreciation is recorded as an expense on the income statement, reducing the net income and the earnings per share, and as a contra-asset on the balance sheet, reducing the book value of the asset.

- Depreciation does not affect the cash flow of the business, as it is a non-cash expense. Therefore, depreciation is added back to the net income in the cash flow statement, increasing the operating cash flow.

- There are different methods of calculating depreciation, such as the straight-line method, the units-of-production method, and the double-declining balance method. Each method has its own assumptions and implications for the financial statements and the tax benefits of the business.

- Depreciation offers benefits, including reducing tax liability, aligning expenses with revenues, and facilitating asset replacement planning. However, it also poses challenges such as potentially inflating net income, diminishing asset value on the books, and introducing complexity and inconsistency into accounting processes.

We hope you found this blog post informative and helpful about Journal Entries for Depreciation. If you have any questions or comments, please feel free to leave them below. We would love to hear from you. Thank you for reading.

Share this content: