Introduction

Accounting formulas are the backbone of financial analysis and decision-making. They provide a quantitative way to evaluate a company’s financial health. In this post, we will delve into the Asset Turnover Ratio, a crucial formula in accounting.

Explanation of the Formula

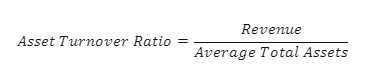

The Asset Turnover Ratio is calculated as follows:

The formula consists of two components:

- Revenue: This is the total income generated by the business from its operations.

- Average Total Assets: This is the average value of the company’s assets during a specific period.

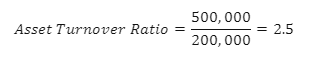

For example, if a company’s revenue is $500,000 and its average total assets are $200,000, the Asset Turnover Ratio would be:

This means that for every dollar in assets, the company generates $2.5 in revenue.

Purpose and Significance

The Asset Turnover Ratio is a measure of a company’s efficiency in using its assets to generate revenue. A higher ratio indicates that the company is more efficient at using its assets to generate revenue.

Practical Applications

The Asset Turnover Ratio is used across industries to assess a company’s efficiency in using its assets. It is particularly relevant for capital-intensive businesses, such as manufacturing companies.

Common Mistakes and Pitfalls

A common mistake is interpreting a high Asset Turnover Ratio as always being positive. While a high ratio can indicate that the company is effectively using its assets, it could also suggest that the company is overworking its assets, which could lead to wear and tear and increased maintenance costs.

Calculation and Interpretation

Calculating the Asset Turnover Ratio involves dividing the revenue by the average total assets. The result is a measure of the revenue generated for each dollar of assets. However, interpreting this measure requires understanding the company’s industry norms and operational efficiency.

Advanced Topics

There are variations of the Asset Turnover Ratio, such as the Fixed Asset Turnover Ratio, which only considers fixed assets in the denominator.

Conclusion

Understanding the Asset Turnover Ratio is crucial for assessing a company’s efficiency and operational effectiveness. It provides a valuable tool for evaluating a company’s asset utilization and financial health.