Introduction

Accounting formulas are the backbone of financial analysis, providing a quantitative lens to assess a company’s financial health. One such critical formula is the Debt to Equity Ratio, defined as:

Explanation of the Formula

The Debt to Equity Ratio is a financial leverage ratio that compares a company’s total debt to its shareholders’ equity.

- Total Debt: This includes all short-term and long-term obligations of the company.

- Shareholders’ Equity: This represents the net value of the company, calculated as total assets minus total liabilities.

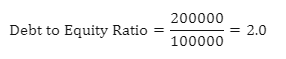

For example, if a company has total debt of $200,000 and shareholders’ equity of $100,000, the Debt to Equity Ratio would be:

This means that the company has twice as much debt as equity.

Purpose and Significance

The Debt to Equity Ratio is a key measure of a company’s financial leverage. It provides insights into the company’s capital structure and risk profile.

Practical Applications

The Debt to Equity Ratio is widely used across industries to assess a company’s financial leverage. It is particularly relevant in capital-intensive industries where companies often rely on debt financing.

Common Mistakes and Pitfalls

One common mistake is to interpret a high Debt to Equity Ratio as a bad sign. While a high ratio may indicate higher risk, it could also mean that the company is using debt financing to fuel growth.

Calculation and Interpretation

Calculating the Debt to Equity Ratio involves dividing the total debt by the shareholders’ equity. The result is a ratio that provides an indication of the company’s financial leverage. A ratio above 1 indicates that the company has more debt than equity, which may suggest higher financial risk.

Conclusion

Understanding the Debt to Equity Ratio is crucial in accounting and finance. It provides key insights into a company’s financial leverage and risk profile. By applying this knowledge, you can make more informed decisions in your accounting practices or studies.

Share this content: