External financial reporting decisions are crucial for businesses and organizations, as they allow stakeholders to understand their financial performance and make informed decisions. Financial reporting refers to the process of producing financial statements, which are documents that present the financial position, performance, and cash flows of a company or organization. The financial reporting environment encompasses the various laws, regulations, and standards that govern financial reporting, as well as the stakeholders who use financial statements for decision-making purposes.

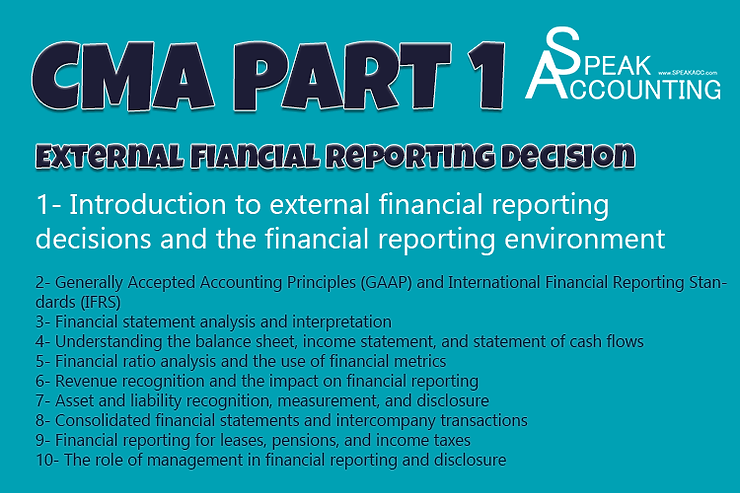

Introduction to External Financial Reporting Decisions and the Financial Reporting Environment

Financial reporting is an essential component of the business and financial landscape. It provides stakeholders with information about a company’s financial performance and position, which can be used to make informed decisions about investing lending, and other financial transactions. In this blog post, we will discuss the objectives of financial reporting, the financial reporting environment, the stakeholders of financial reporting, the challenges and limitations of financial reporting, and the importance of financial reporting.

The Importance of Financial Reporting

Financial reporting plays a crucial role in the functioning of capital markets. It provides investors with the information they need to make informed decisions about investing in a company. Additionally, financial reporting provides valuable information to creditors, customers, employees, and regulators. Financial reporting also promotes transparency and accountability, which helps maintain investor confidence and trust in the financial system.

What is Financial Reporting?

Financial reporting refers to the process of disclosing financial information to external users. The information is typically presented in the form of financial statements, which provide an overview of a company’s financial performance and position. Financial statements can be used to assess a company’s profitability, liquidity, solvency, and cash flow.

Objectives of Financial Reporting

The primary objective of financial reporting is to provide useful information to external users. Specifically, financial reporting aims to provide information that is:

- Relevant: The information should be relevant to the needs of users.

- Reliable: The information should be accurate and free from bias.

- Comparable: The information should be presented in a way that allows for comparison between different companies and time periods.

- Understandable: The information should be presented in a way that is understandable to users who may not be financial experts.

The Financial Reporting Environment

The financial reporting environment encompasses the laws, regulations, and standards that govern financial reporting. In the United States, the Securities and Exchange Commission (SEC) is responsible for regulating financial reporting by publicly-traded companies. The SEC requires companies to follow generally accepted accounting principles (GAAP) when preparing financial statements.

Standards and Regulations Governing Financial Reporting

The Financial Accounting Standards Board (FASB) is responsible for developing and updating GAAP. The International Accounting Standards Board (IASB) sets International Financial Reporting Standards (IFRS), which are used in many countries worldwide. Both GAAP and IFRS provide guidelines for financial reporting, including the types of financial statements that must be prepared and the information that must be disclosed in those statements.

Types of Financial Statements

There are three main types of financial statements: the balance sheet, the income statement, and the statement of cash flows.

1- The Balance Sheet

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It lists the company’s assets, liabilities, and equity. Assets are resources that the company owns or controls, such as cash, inventory, and property. Liabilities are obligations that the company owes to others, such as loans and accounts payable. Equity represents the residual interest in the assets of the company after deducting liabilities.

2- The Income Statement

The income statement provides information about a company’s revenues and expenses over a specific period of time. It shows how much money the company earned and how much it spent during that period. The bottom line of the income statement is net income, which represents the company’s profit or loss for the period.

3- The Statement of Cash Flows

The statement of cash flows provides information about a company’s cash flows over a specific period of time. It shows where the company’s cash came from and how it was used. The statement of cash flows is divided into three sections: operating activities, investing activities, and financing activities.

Stakeholders of Financial Reporting

Financial reporting serves the needs of a variety of stakeholders. These stakeholders include investors, creditors, customers, employees, and regulators. Each group has specific needs that must be met by financial reporting.

- Investors: Investors use financial statements to make informed decisions about investing in a company. They are interested in a company’s financial performance and position, and they use financial statements to assess a company’s profitability, liquidity, and solvency.

- Creditors: Creditors use financial statements to assess a company’s creditworthiness. They are interested in a company’s ability to repay its debts and meet its financial obligations.

- Customers: Customers may use financial statements to assess a company’s financial stability and reputation. They may be more likely to do business with a company that has a strong financial position.

- Employees: Employees may use financial statements to assess a company’s financial health and stability. They may be more likely to stay with a company that has a strong financial position.

- Regulators: Regulators use financial statements to monitor companies and enforce financial regulations. They may use financial statements to detect fraud or other financial irregularities.

Challenges and Limitations of Financial Reporting

Despite the benefits of financial reporting, there are several challenges and limitations that must be addressed. Some of the main challenges and limitations include:

- The complexity of Financial Reporting: Financial reporting can be complex and difficult to understand, even for financial experts. This can make it difficult for non-expert users to make informed decisions.

- Subjectivity in Financial Reporting: Financial reporting often involves judgment calls and estimates. This can lead to differences in how companies report their financial information, which can make it difficult to compare companies.

- Manipulation of Financial Statements: Companies may engage in financial statement manipulation to make their financial position appear stronger than it actually is. This can include things like inflating revenue or understating expenses.

- Timing of Financial Statements: Financial statements are typically prepared on a quarterly or annual basis. This means that they may not provide up-to-date information about a company’s financial position.

Conclusion

In conclusion, financial reporting is an essential component of the business and financial landscape. It provides stakeholders with valuable information about a company’s financial performance and position. Financial reporting promotes transparency and accountability, which helps maintain investor confidence and trust in the financial system. While there are challenges and limitations associated with financial reporting, it remains an important tool for investors, creditors, and other stakeholders.

Read More

- The Impact of Artificial Intelligence on Accounting and Finance: Revolutionizing the Future

- 10 Essential Tax Deductions for Small Businesses: Maximizing Your Savings

- The Relationship Between Chat GPT and Accounting

- How Many Bank Accounts Should a Small Business Have?

- Why is Personal Finance Dependent Upon Your Behavior?