CMA or Masters in Accounting:

When it comes to advancing your career in the field of accounting, two prominent options often come to mind: earning your Certified Management Accountant (CMA) certification or pursuing a Masters in Accounting (MAcc) degree. Both paths offer unique benefits and can greatly contribute to your professional growth. In this article, we will explore the differences between the two and help you make an informed decision that aligns with your career goals.

Understanding the CMA Certification:

The Certified Management Accountant (CMA) designation is a highly respected credential offered by the Institute of Management Accountants (IMA). This certification is specifically tailored to individuals who aspire to become management accountants, a role that involves analyzing financial information, preparing budgets, and providing strategic financial advice to guide business decisions.

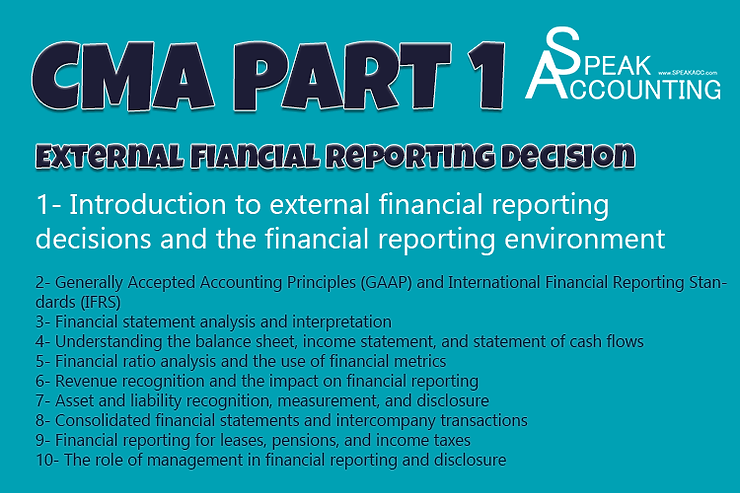

CMA candidates undergo a rigorous process that includes passing a comprehensive exam and meeting certain educational and work experience requirements. The CMA exam covers topics such as financial planning, performance management, internal controls, and risk management. To earn your CMA, you’ll need to complete a CMA review course, which helps you prepare for the exam and gain a deep understanding of the material.

Benefits of Earning a CMA:

- Specialized Expertise: The CMA certification equips you with specialized skills that are highly relevant to management accounting roles. This targeted knowledge can set you apart in the job market and make you a valuable asset to organizations.

- Career Growth: Management accountants play a crucial role in business decision-making. Earning your CMA can open doors to various leadership positions and enhance your career trajectory.

- Global Recognition: The CMA certification is recognized worldwide, allowing you to pursue opportunities both domestically and internationally.

- IMA Membership: As a CMA, you automatically become a member of the IMA, a professional association that offers networking opportunities, resources, and a supportive community.

Exploring the Masters in Accounting:

A Master in Accounting (MAcc) degree is a graduate-level program that delves deeper into the various facets of accounting. This degree is particularly appealing to individuals who wish to gain a comprehensive understanding of accounting principles, taxation, auditing, and financial reporting.

MAcc programs are often offered by business schools and universities, and they cater to individuals with varying levels of accounting knowledge. Whether you’re a recent graduate with an undergraduate degree in accounting or an experienced professional looking to refine your skills, a MAcc can provide you with advanced knowledge and a broader perspective on accounting practices.

Advantages of Pursuing a MAcc:

- Holistic Learning: A Master in Accounting program covers a wide range of accounting-related subjects, enabling you to develop a well-rounded skill set that goes beyond management accounting.

- Flexible Career Paths: While a CMA certification is tailored to management accounting, a MAcc degree allows you to explore different areas of accounting, such as auditing, taxation, and financial analysis.

- Comprehensive Curriculum: MAcc programs often include case studies, real-world projects, and experiential learning opportunities, giving you practical exposure to the complexities of accounting.

- Networking Opportunities: Business schools offering MAcc programs typically have strong alumni networks and connections with potential employers, enhancing your job prospects upon graduation.

Choosing the Right Path for You:

The decision between pursuing a CMA certification or a Master’s in Accounting depends on your career goals, educational background, and personal preferences. Here are some factors to consider when making your choice:

- Career Path: If you are certain that you want to specialize in management accounting and contribute to strategic decision-making, the CMA certification might be the better fit. On the other hand, if you’re interested in a broader spectrum of accounting roles, a MAcc degree could be more suitable.

- Time and Commitment: Earning a CMA certification typically requires passing a two-part exam, while a MAcc program could take one to two years to complete. Consider your time constraints and how quickly you want to enter the job market.

- Educational Background: If you have an undergraduate degree in accounting or a related field, you might find it easier to meet the CMA requirements. A MAcc program can be a great choice if you’re looking to switch careers or enhance your existing knowledge.

Conclusion

In conclusion, both the CMA certification and a Master’s in Accounting offer valuable opportunities for professional growth in the field of accounting. The CMA route focuses on specialized expertise and management accounting, while a MAcc degree provides a comprehensive education in various accounting disciplines. Assess your career goals, educational background, and preferences to make the choice that aligns with your aspirations. Whether you choose the CMA or MBA path, both options can lead you to a rewarding and successful career as a certified accounting professional.