How to Record Rent Expense Journal Entry: A Step-by-Step Guide

Accurate accounting is crucial for any business, and keeping track of rent expense is no exception. This seemingly simple transaction can have a significant impact on your financial statements and ultimately, your decision-making.

In short: to record rent expense, you’ll use a simple journal entry involving two accounts: Rent Expense (Debit) and either Cash (Credit) or Rent Payable (Credit).

Understanding the Basics

Rent expense is the cost incurred for using a property for a specific period. It’s a crucial element of your income statement, reflecting the recurring cost associated with your business operations. It’s important to distinguish expense from rent payable. Rent expense represents the actual cost incurred, while rent payable is the amount owed but not yet paid.

The Journal Entry

To record rent expense, you’ll use a simple journal entry involving two accounts:

Step 1: Identify the accounts involved:

- Rent Expense (Debit): This account reflects the cost of the rent incurred.

- Cash (Credit): This account decreases when cash is paid out for rent.

- Rent Payable (Credit): This account increases when rent is owed but not yet paid.

Step 2: Understand the debit and credit sides:

- Debit: Increases expense accounts, signifying the cost incurred.

- Credit: Decreases asset accounts (cash) or increases liability accounts (rent payable).

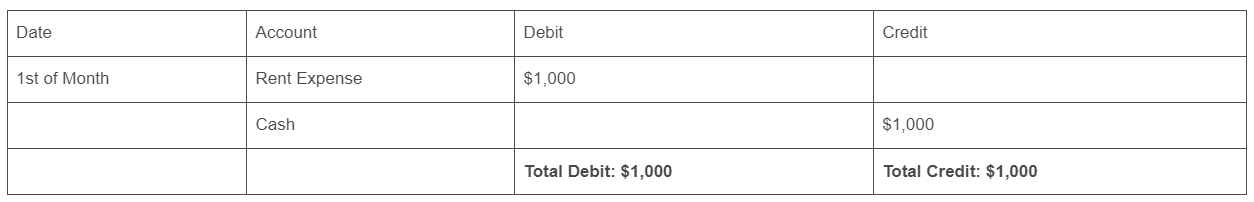

Step 3: Example Journal Entry:

Let’s assume your monthly rent is $1,000 and you paid it on the 1st of the month. The journal entry would look like this:

Debit rent expense $1,000

Credit Cash $1,000

Different Scenarios

Rent Paid in Advance:

Sometimes, you might pay rent in advance for multiple periods. This is called prepaid rent. The initial journal entry would debit a prepaid rent asset account and credit cash. As time passes, you’ll need to adjust the prepaid rent account by debiting expense and crediting prepaid rent.

For a detailed guide on recording and adjusting prepaid rent, check out our blog post: “How to Record Prepaid Rent Journal Entry: A Step-by-Step Guide“

Rent Paid in Arrears:

If you pay your rent after the period has ended, you’re paying in arrears. This creates accrued rent, a liability on your balance sheet. The initial journal entry would debit expense and credit accrued rent. As you make the payment, you’ll debit accrued rent and credit cash.

Rent Inclusions:

Rent often includes additional costs, like utilities or property taxes. You’ll need to allocate these expenses separately to accurately reflect their impact on your financial statements.

Tips for Accurate Recording

- Keep track: Maintain records of all rent payments and invoices.

- Software: Use a dedicated accounting software for easy recording and tracking.

- Reconciliation: Regularly reconcile your expense account with your bank statements to ensure accuracy.

Conclusion

Recording expense correctly is essential for maintaining accurate financial records. By understanding the journal entry process and adapting it to different scenarios, you can ensure that your financial statements reflect the true cost of your business operations.

FAQs

- What if I don’t pay rent on time? This will create an accrued liability. You’ll need to adjust your journal entry to reflect the late payment and any potential penalties.

- How do I record rent for a partial month? Calculate the prorated expense based on the number of days occupied.

- Can I deduct rent expense on my taxes? Yes, this expense is typically deductible for tax purposes. Consult a tax professional for specific guidance.

Share this content:

Post Comment

You must be logged in to post a comment.