Introduction

Accounting formulas are the backbone of financial analysis and decision-making. They provide a quantitative way to evaluate a company’s financial performance. In this post, we will delve into the Accounts Receivable Turnover Ratio, a crucial formula in accounting.

Explanation of the Accounts Receivable Turnover Ratio Formula

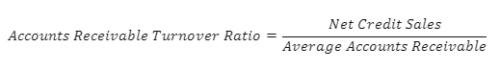

The AR Turnover Ratio is defined as:

The formula consists of two components:

- Net Credit Sales: This is the total sales on credit minus any returns or allowances.

- Average Accounts Receivable: This is the average amount of money owed to the business by its customers.

For example, if a company’s net credit sales are $500,000 and its average accounts receivable is $50,000, the AR Turnover Ratio would be:

This means that the company collects its receivables ten times during the period.

Purpose and Significance

The AR Turnover Ratio measures how efficiently a company collects its receivables. A high ratio indicates that receivables are collected frequently, suggesting effective credit and collection processes. Conversely, a low ratio may indicate problems in the collection process or credit policy.

Practical Applications

The AR Turnover Ratio is widely used across industries, especially in businesses that offer credit to their customers. It helps businesses optimize their credit policies and improve cash flow.

Common Mistakes and Pitfalls

One common mistake is comparing AR Turnover Ratios across different industries, as the ratio can vary significantly. Also, businesses with different credit policies may have different ratios, so it’s important to consider the company’s credit policy when interpreting the ratio.

Calculation and Interpretation

Calculating the AR Turnover Ratio involves dividing the net credit sales by the average accounts receivable. The result is a ratio that provides insight into the company’s credit and collection efficiency. However, interpreting this ratio requires understanding the company’s industry norms and credit policies.

Advanced Topics

There are variations of the Accounts Receivable Turnover Ratio, such as the Days Sales Outstanding (DSO), which measures the average number of days a company takes to collect its receivables.

Conclusion

Understanding the AR Turnover Ratio is crucial for effective credit and collection management. It provides a valuable tool for assessing a company’s efficiency and profitability.