Introduction

Accounting formulas are essential tools for financial analysis and decision-making. They provide a quantitative way to assess a company’s financial health. In this post, we will explore the Days Sales Outstanding (DSO), a key formula in accounting.

Explanation of the Formula

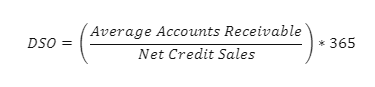

The Days Sales Outstanding (DSO) is calculated as follows:

The formula consists of two components:

- Average Accounts Receivable: This is the average amount of money owed to the business by its customers.

- Net Credit Sales: This is the total sales on credit minus any returns or allowances.

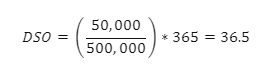

For example, if a company’s average accounts receivable is $50,000 and its net credit sales are $500,000, the DSO would be:

This means that, on average, it takes the company 36.5 days to collect its receivables.

Purpose and Significance

The DSO is an important measure of a company’s liquidity and efficiency. It indicates how long it takes for a company to collect its accounts receivable. A lower DSO suggests that the company collects its receivables quickly, which is beneficial for its cash flow.

Practical Applications

The DSO is used across industries to assess a company’s efficiency in collecting its receivables. It is particularly relevant for businesses that offer credit to their customers.

Common Mistakes and Pitfalls

A common mistake is comparing DSOs across different industries, as the DSO can vary significantly. Also, seasonal variations can affect the DSO, so it’s important to consider these factors when interpreting the DSO.

Calculation and Interpretation

Calculating the DSO involves dividing the average accounts receivable by the net credit sales, and then multiplying the result by 365. The result is a measure of the average number of days it takes for a company to collect its receivables. However, interpreting this measure requires understanding the company’s industry norms and credit policies.

Advanced Topics

There are variations of the DSO, such as the Weighted Average DSO, which takes into account the age of each receivable.

Conclusion

Understanding the DSO is crucial for assessing a company’s liquidity and efficiency. It provides a valuable tool for evaluating a company’s credit and collection policies.